irs tax levy letter

The IRS is required to release a levy if it determines that. The period the IRS can collect the tax ended before the.

Irs Letter 728 Current Balance Due H R Block

If you do not.

. However you would like. For example if you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assets. The CP15 notice is not an IRS Tax Levy but instead a Notice of Penalty and the first rung of the IRS tax levy ladder.

Contact the IRS immediately to resolve your tax liability and request a levy release. This levy will remain in effect until the balance is paid in full or you. The IRS is required to notify you again prior to levy whenever any new ie additional tax assessments are applied to your IRS account.

It informs you that unless you pay the full amount due so much for the installment agreement you run the risk of. The levy proceeds have been received by the IRS and applied to your tax debt. The next step you will want to do is gather all of your financial documents and call our firm.

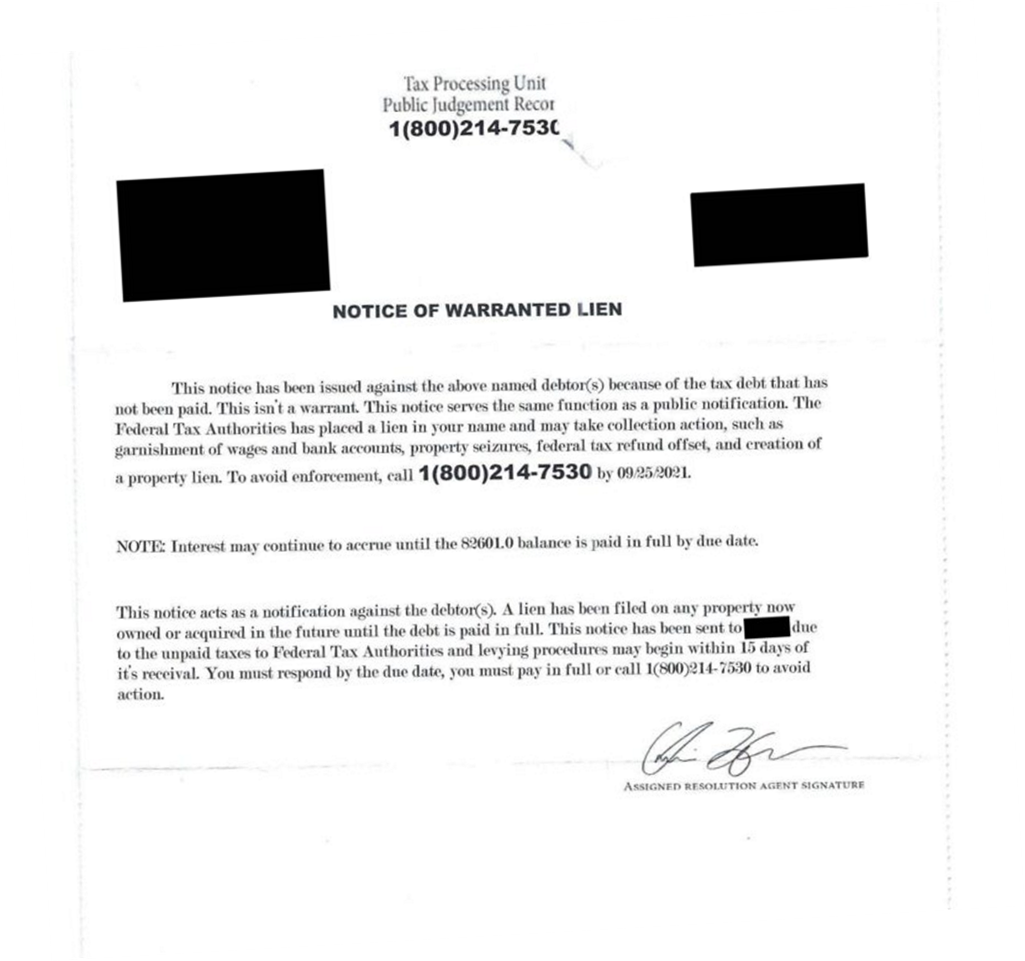

A levy is a legal seizure of your property to satisfy a tax debt. 18 hours agoIf you believe this letter may be a scam or marketing scheme dont call the phone number in the letter. The first thing to do is to check the return address to be sure the letter or notice is from the Internal Revenue Service and not another agency or a scammer.

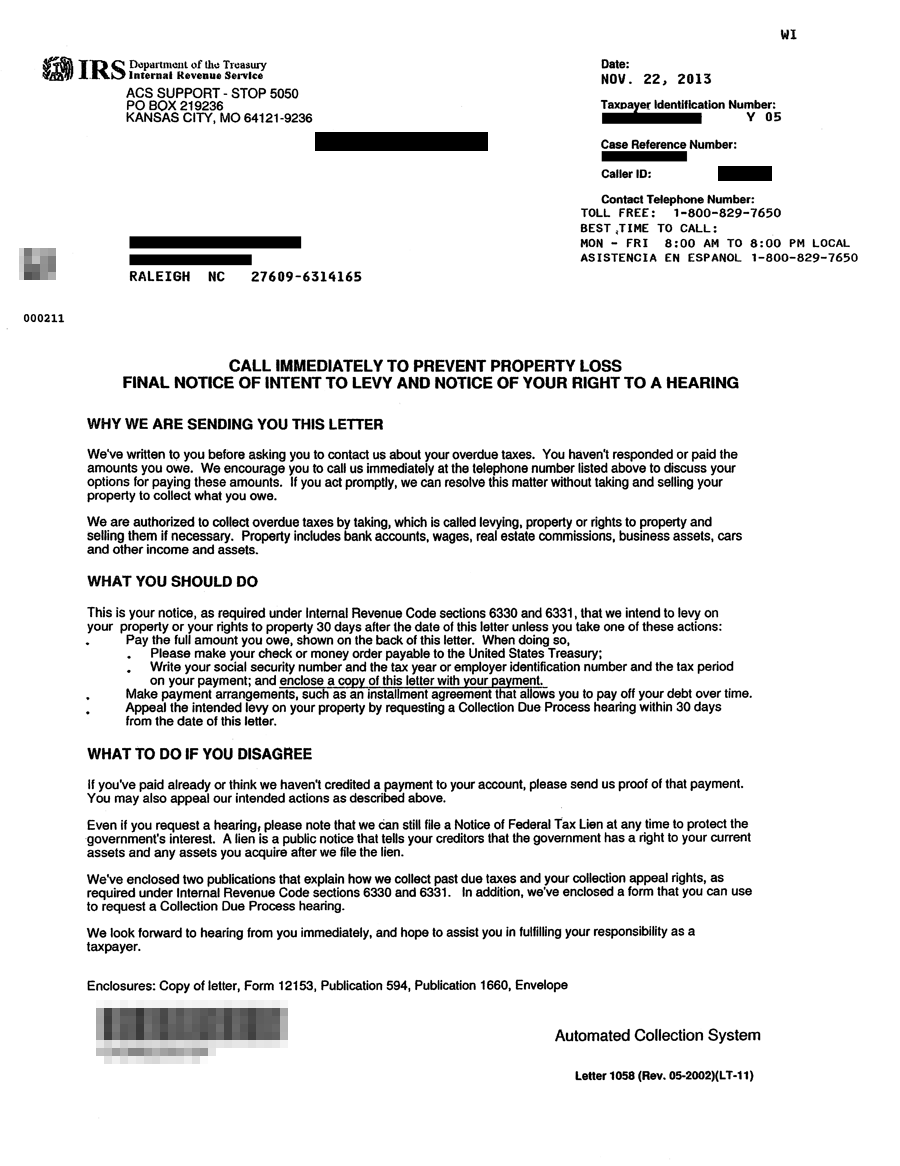

If you receive an IRS bill titled Final Notice Notice of Intent to Levy and Your Right to A Hearing. Levies are different from liens. It is different from a lien while a lien makes a claim to.

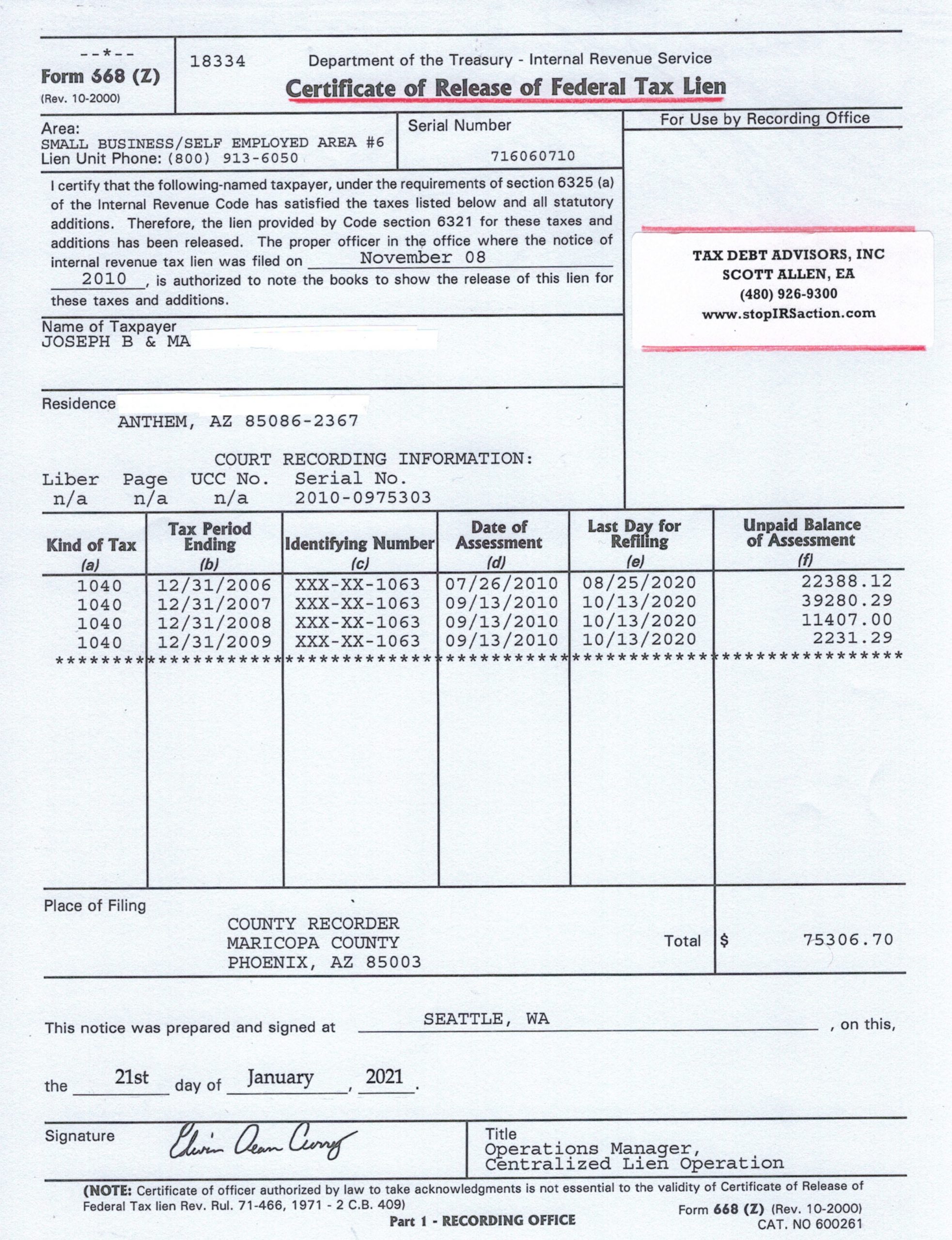

The language of the CP523 letter is no joke. The CP523 Letter. Letter 3172 Notice of Federal Tax Lien Filing and Your Rights to a Hearing under IRC 6320.

The IRS can seize a residence if the taxpayer owes more than 5000 and the house has value under the tax seizure rules. This letter is required by IRC 6331 before the IRS issues a levy unless collection is in jeopardy to collect tax from most sources. Instead go to irsgov to get further information on how to confirm its.

Taxpayers are not entitled to a pre. The IRS can also release a levy if it determines that the levy is causing an immediate. An IRS levy letter also authorizes the Service to.

If you do not respond to the IRS in a timely manner a portion of your social security payment will be held for IRS back taxes. We will help put together your case to the IRS and represent you to let them know that. You paid the amount you owe and no longer have a balance.

The IRS notifies you of its intent to levy by. This letter is to notify you the IRS filed a notice of tax lien for the unpaid taxes. IRS Letter 2645C indicates the IRS is working on a response to their account but needs an additional 60 days to send the complete response with the action the IRS is taking.

The IRS has issued a levy to collect on the balance that you owe. This is the letter you receive before the IRS levies your assets. A notice of levy from IRS is also called an IRS notice of intent to seize your property.

The notice may tell you that the IRS plans. Even if you think you do not owe the tax bill you should contact the IRS. A lien is a legal claim against property to secure payment of the.

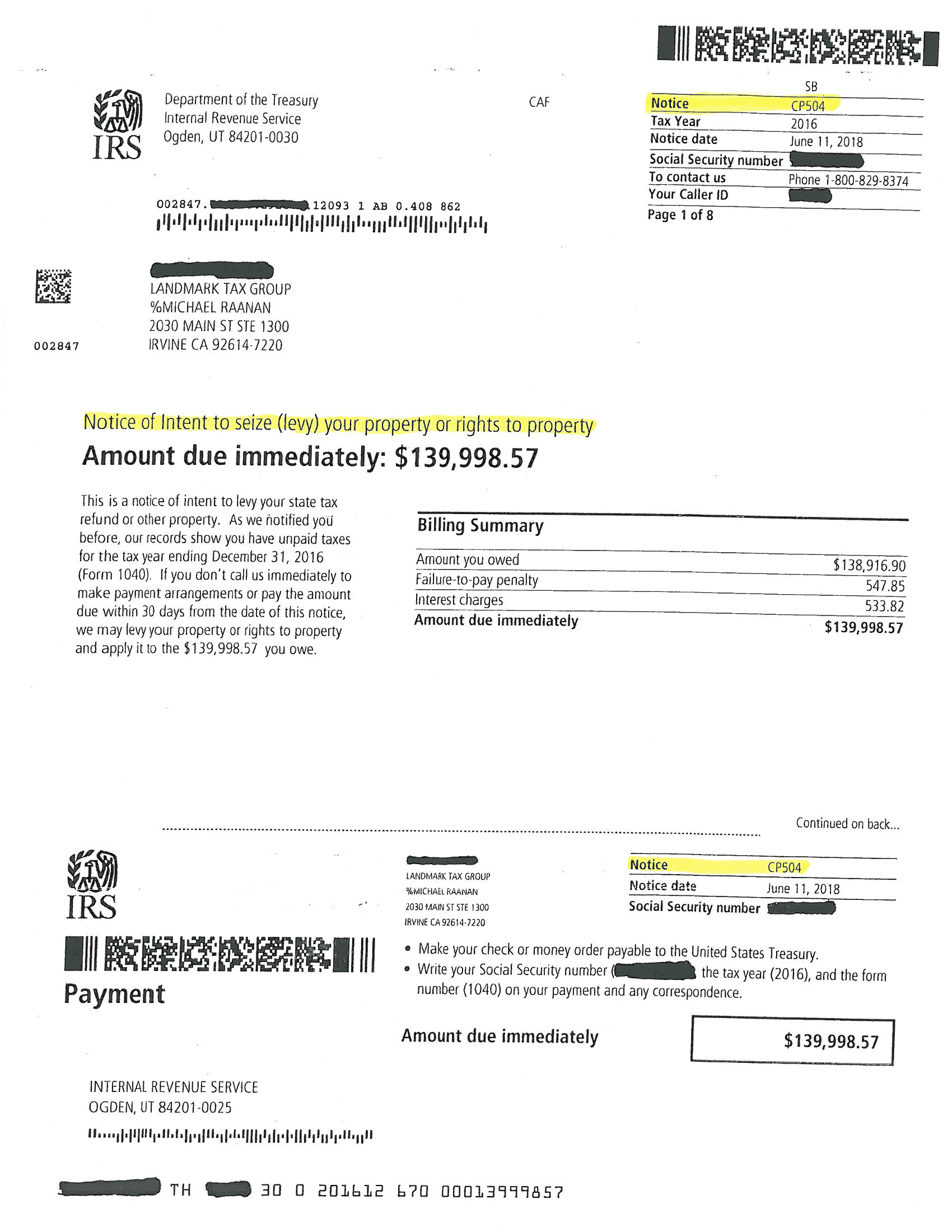

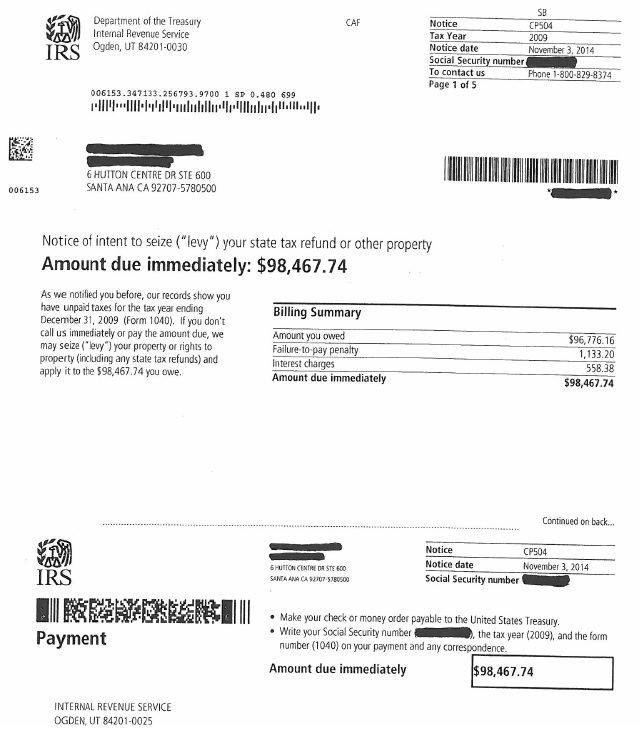

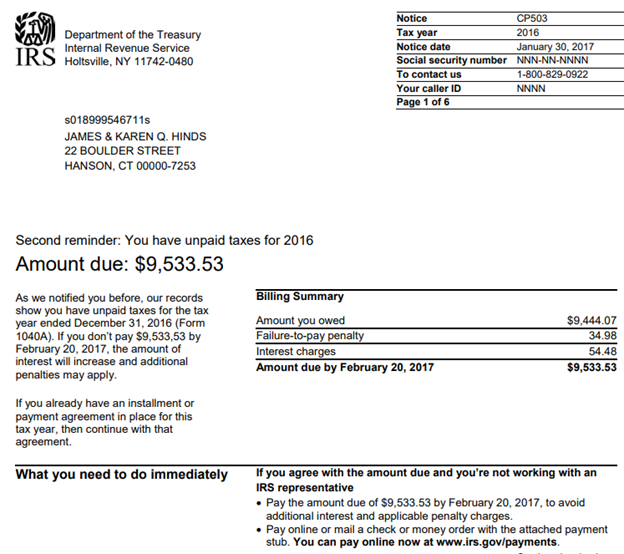

CP504 Penalty Notice and Tax Levy Warning. The IRS offers a way to make a dent in what you owe through entering into an installment agreement a simple and manageable option to repay each month.

Mn Irs Notice Of Intent To Levy Lt11 Know What To Do Southwest Minneapolis Mn Patch

Irs Cp504 Tax Notice What Is It Landmark Tax Group

Irs Notice Lt11 Letter 1058 How To Respond Rush Tax

5 12 3 Lien Release And Related Topics Internal Revenue Service

Irs Tax Letters Explained Landmark Tax Group

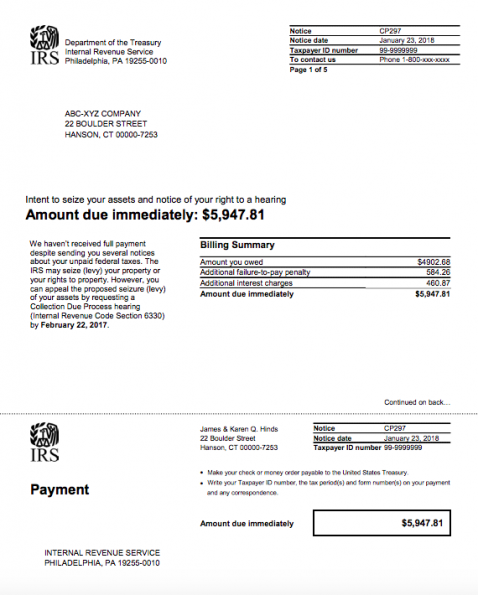

Irs Notice Cp297 What Is Irs Notice Of Intent To Levy Supermoney

3 Things You Should Do Immediately When The Irs Sends You Notice Of Intent To Levy Tony Ramos Law

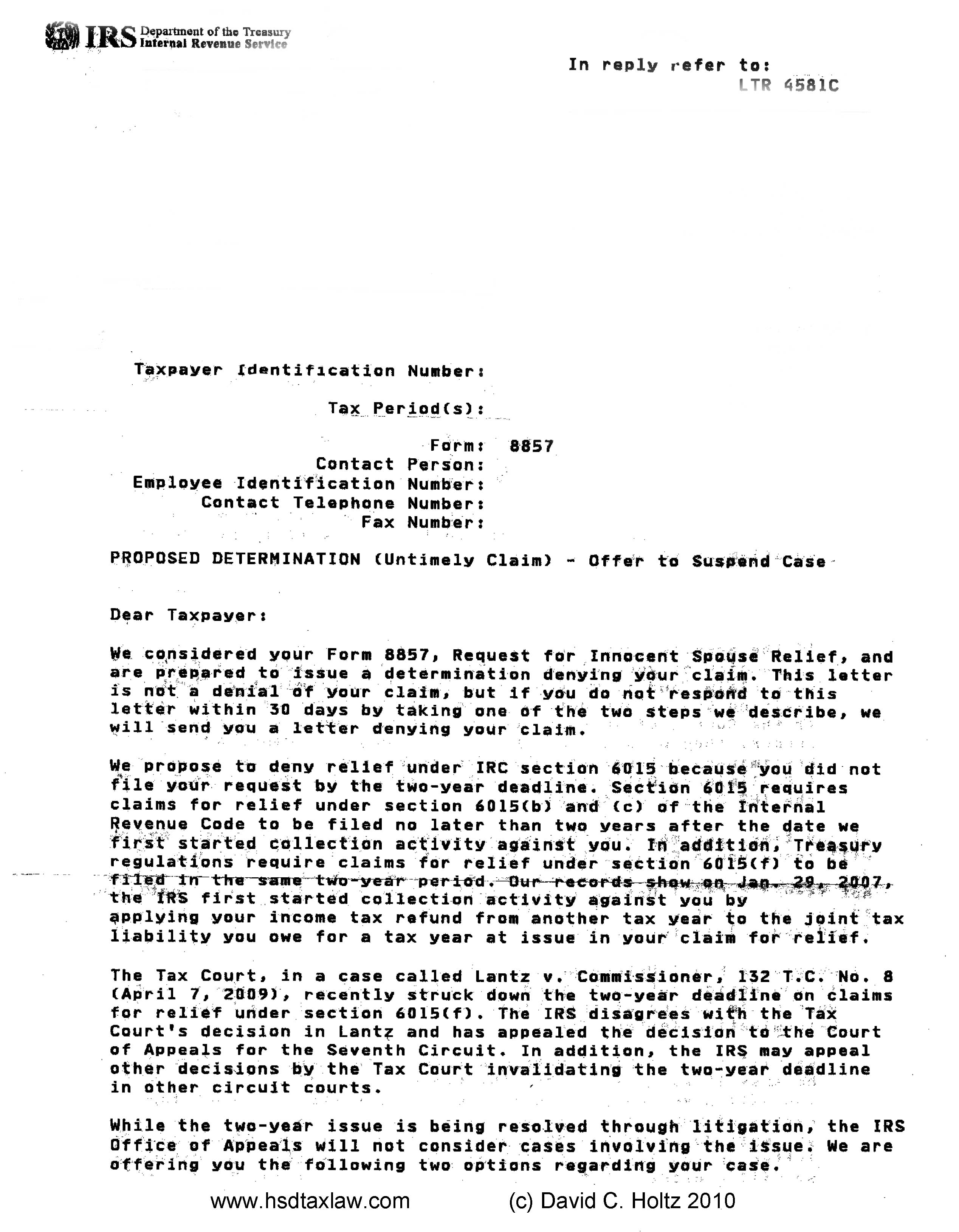

Irs Form Letter 4581c Offer To Suspend Innocent Spouse Case Holtz Slavett Drabkin Aplc

Tax Letters Washington Tax Services

How To Know If You Have Received A Fake Irs Collection Letter Irs Tax Attorney Howard Levy

Irs Audit Letter Cp92 Sample 1

Irs Just Sent Me A Notice Of Intent To Levy Intent To Terminate Your Installment Agreement Cp 523 What Should I Do Legacy Tax Resolution Services

Irs Audit Letter Cp14 Sample 1

Scott Allen Ea For Irs Tax Relief Page 3 Tax Debt Advisors

Have You Received An Irs Tax Collection Notice

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group

Irs Tax Lien In Arizona Irs Help From Tax Debt Advisors Inc Tax Debt Advisors